Climate Change Materiality Assessment

Integrating ORSA and CSRD using Climate Scenario Data and Facilitating EU Taxonomy Alignment

With the escalating global focus on climate change, insurance companies worldwide are compelled to integrate multifaceted climate data into their risk management and strategic planning processes. The European Own Risk and Solvency Assessment (ORSA) framework is instrumental in such endeavours, but it requires access to reliable data sources. One such source is the climate scenario data from the National Meteorological and Hydrological Institutes (NMHI; e.g. SMHI for Sweden, DMI for Denmark and MET Norway) that provide projections of the possible effects of climate change up to the year 2100.

ORSA, CSRD and the EU Taxonomy

ORSA provides insurers with a systematic method to assess their specific risks and future capital needs. In the context of climate change, ORSA acts as a framework to pinpoint and quantify impending challenges that may impact risk profile and financial materiality. By modelling various climate scenarios, ORSA empowers insurance companies with valuable input to make more informed, data-driven decisions concerning their strategic future. The assessment of financial materiality of sustainability topics linked to climate change in the ORSA also facilitates sustainability reporting in accordance with Corporate Sustainability Reporting Directive (CSRD) (Directive (EU) 2022/2464) and the European Sustainability Reporting Standards (ESRS)[1] when it comes to identifying and specifying specific data points that are required to be disclosed.

The EU Taxonomy (Regulation (EU) 2020/852) offers a standardised classification system, assisting insurance companies in recognising which of their activities align with environmental sustainability. The Taxonomy acts as a refining filter: ORSA lays down the overarching framework for risk management, while the EU Taxonomy fine-tunes it, ensuring that risk mitigation efforts and actions to reduce negative impact are not just effective, but also take environmental sustainability into account.

Example: Incorporation of Climate Scenario Data

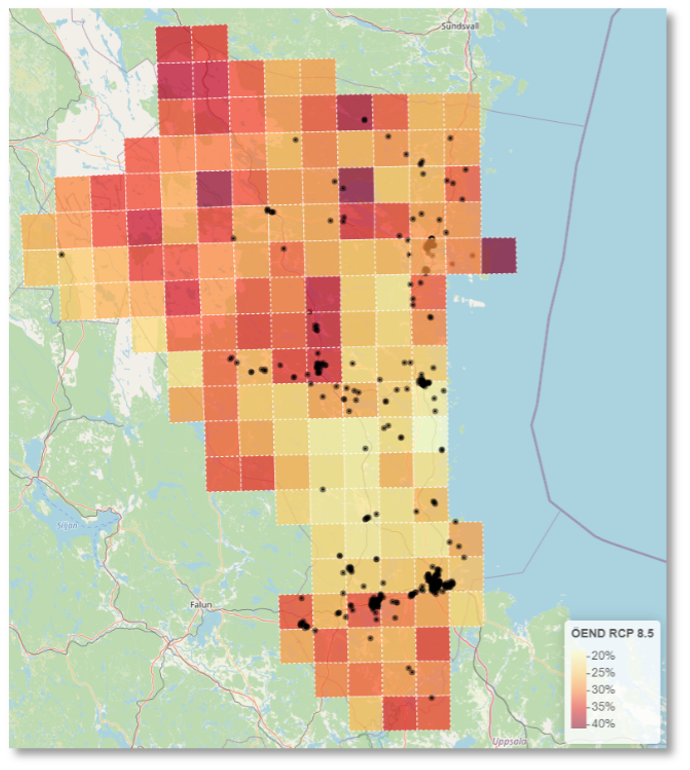

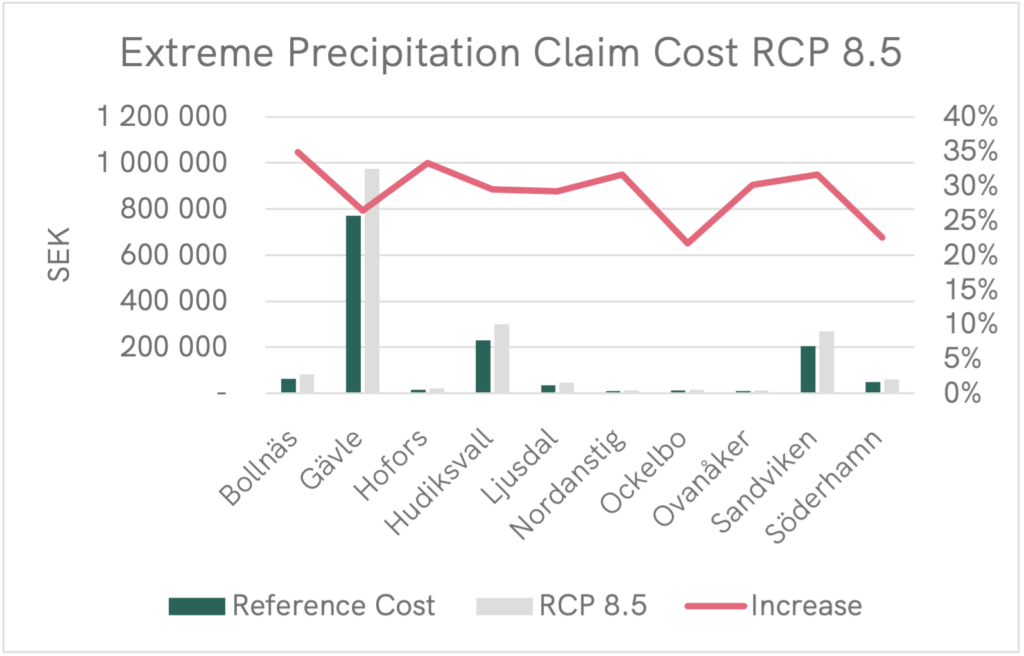

The projections on extreme precipitation events from SMHI for the span of 2011-2040 are centered around the Intergovernmental Panel on Climate Change (IPCC) Representative Concentration Pathway (RCP) greenhouse gas emission scenarios, with data derived from 61 climate model runs. These models come from leading institutions in climate modeling such as the Max Planck Institute for Meteorology, Centre National de Recherches Météorologiques, and the Met Office Hadley Centre, among others. While this example focuses on RCP 8.5 for the specified timespan, other scenarios and timespans are also available for analysis. Crucially, the SMHI data is supplemented with information about insured objects from insurance companies seen in Figure 1. This combination provides insurance companies with an invaluable tool to measure potential impacts and devise effective mitigation strategies.

IPCC WGI Interactive Atlas: A Preliminary Guide

Though the primary data integration comes from projections provided by National Meteorological and Hydrological Institutes, the IPCC WGI Interactive Atlas serves an initial screening role. The Interactive Atlas allows users to delve into climatic impact-drivers across regions, highlighting both current trends and future projections. This facilitates informed decision-making and sets the stage for deeper analyses using specialised datasets.

Materiality assessment of Climate Change Risks and Opportunities

A structured approach entailing the combination of ORSA, EU Taxonomy, data provided by National Meteorological and Hydrological Institutes, and IPCC insights presents a robust framework for insurance companies in Europe to assess and mitigate climate risks. This method facilitates a seamless transition from a broad understanding of climate risks to more detailed and localised assessments, ultimately leading to data-driven decision-making.

- Preliminary Risk Analysis with the IPCC Atlas:

Companies obtain a generalised overview of climate risks prevalent in their operations, aiding in initial risk awareness. - Detailed Risk Assessment with ORSA and CSRD:

Building upon the initial analysis, insurance companies categorize broader risks such as property damage or agricultural losses due to extreme weather events, facilitating a deeper understanding of potential risks and opportunities and their financial materiality. The assessed risks are to be included in the ORSA and disclosed in CSRD in accordance with the ESRS climate change disclosure requirements, together with related opportunities and information on actions to address these. - Refinement using the EU Taxonomy:

This step is crucial for aligning mitigation strategies with sustainability goals and to identify opportunities for how companies can benefit from the mitigation of climate change and the transition to a carbon-neutral society. By referencing the EU Taxonomy, insurance companies can identify sustainable actions and mitigation measures. For instance, they might explore constructing resilient infrastructures, adopting water-efficient practices, or engaging in ecosystem restoration to combat the adverse effects of extreme precipitation. - Data-driven Decision Making using NMHI Data:

With a scenario-focused approach, utilising the data provided by National Meteorological and Hydrological Institutes for the timespan 2011-2040 under the RCP 8.5 scenario, insurance companies can access precise predictions on the severity, frequency, and areas most affected by extreme precipitation, see Figure 2. This data, derived from reputable climate modelling institutions, enables a more accurate formulation of adaptation and mitigation strategies, making them more well-targeted and effective.

Conclusion: Charting a Cohesive Climate Change Strategy

The ever-evolving landscape of climate change necessitates insurers to have the most accurate tools and information at their disposal. The confluence of ORSA, EU Taxonomy, NMHI’s detailed climate scenario data, and initial insights from the IPCC paves the way for a cohesive, informed, and sustainable approach to navigating the challenges of climate change. This also facilitates the implementation of materiality assessment processes that leverage on existing risk management approaches, which enables sustainability reporting in accordance with CSRD and ESRS.

For more information, please contact:

[1] European Commission. (2023). Commission Delegated Regulation (EU) …/… supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standard (C(2023) 5303 final, ANNEX 1). Brussels.