The New CVA-Risk Approaches – Out With the Old and In With the New

Background

The Basel IV framework, which was published in 2017, introduced three new ways to

calculate the capital requirements for credit valuation risk CVA. The new package will

replace all current methods in calculating CVA.

Concerns were raised by banks and supervisors that the 2011 standards for CVA did not

appropriately capture the actual CVA risk banks were exposed to. Three specific criticisms

were raised with respect to those standards, the current approaches lack risk sensitivity,

they do not recognize CVA models developed by banks for accounting purposes and the

approaches do not capture the market risk embedded in the derivative transactions with the

counterparty.

To address those concerns, the BCBS published revised standards in December 2017, as a

part of the final Basel III reforms, and further adjusted their calibration in a revised

publication in July 2020. To better align with the 2020 BCBS standards, several amendments

are to be made to the CRR.

A revised definition of the meaning of CVA risk is introduced to capture both the credit

spread risk of an institution’s counterparty and the market risk of the portfolio of

transactions traded by that institution with that counterparty. Moreover, the new methods

increase transparency and comparability of CVA for regulators.

What’s ahead?

In EBAs amendment to Regulation (EU) No 575/2013 the European Commission introduces

three new methods for calculating CVA risk, the Standardised Approach SA-CVA, the Basic

Approach BA-CVA, and the Simplified approach. The three new approaches will replace all

current CVA models and remove the possibility to apply internal models in measuring CVA

risks, the new methods will enter into force 2025-01-01.

The upcoming methods for calculating CVA risk are more complex than the current Original

Exposure method and the current simplified approach. SA-CVA method considers new

inputs of data which consequently will be burdensome to set up for institutions. The new

approach allows for more granularity and is more risk sensitive. Institutions, therefore,

need to consider new aspects of their CVA risk in terms of market volatilities, correlation

and credit spread risk. Despite the effort setting up and considering new aspects the new

approach incorporates recognition of internal hedges, which will allow institution to

mitigate some of their CVA-risk.

Institutions need to request approval from competent authorities to use SA-CVA, without

approval from the supervisory authority the institution needs to use the Basic Approach.

After approval for using the SA-CVA institutes are allowed to combine the SA-CVA and BACVA

approach for different counterparties and for different netting sets with the same party.

Institutions will also have the option of setting its CVA capital requirement to 100 % of the

CCR capital requirement, this is possible for institutes that have an aggregated notional

amount of non-OTC equal or less than 100 BN EUR. The simplified method will in similarity

to the current alternative to OEM method be less burdensome to calculate, however, the

new simplified method will in most cases drive a higher CVA capital requirement than SACVA

and the BA-CVA.

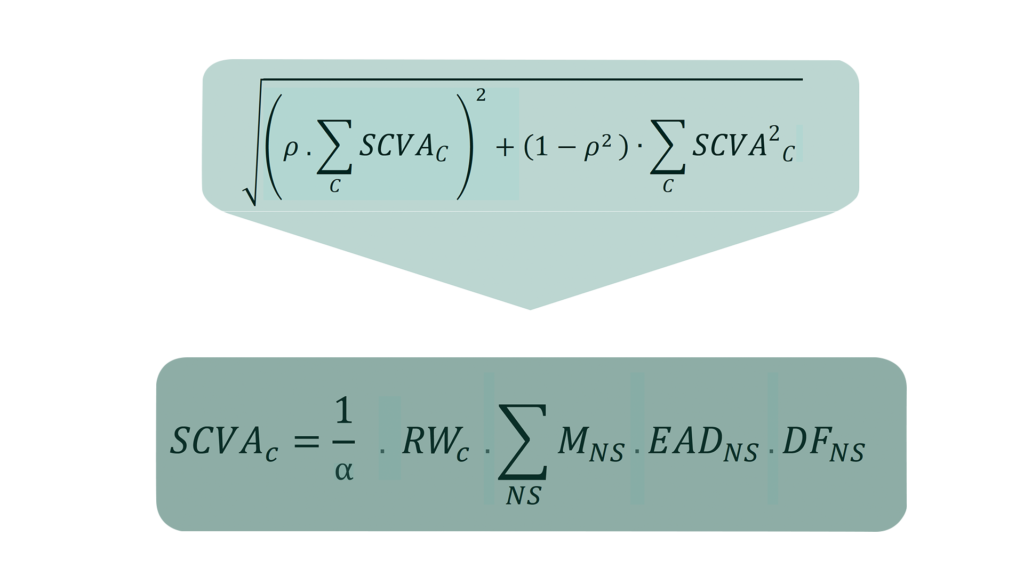

Basic approach

The Basic approach considers elements such as correlation between credit risk spread

between any counterparties. In similarity to current methods, the calculation of the CVA is

across netting sets with each counterparty. Applicable risk weight needs to be assigned

depending on the sector of the counterparty and investment grade. The supervisory risk

weight will range from 0,5 % to 12 %, FX-derivatives and IR-swaps with financial

counterparties of credit quality step 1 to 3 will be set to 5%. The risk weight reflects the

volatility of the credit spread. The effective maturity also needs to be considered, for

institutes that do not use internal models the effective maturity is equal to the weighted

average maturity of cashflows within a netting set, an additional consideration is that the

effective maturity needs to be discounted with a supervisory discount factor. The exposure

at default will remain the same as in current regulation, meaning that the EAD will be equal

to CCR EAD.

Capital requirement for CVA without hedges

NS = Relevant netting set

M = The effective maturity of a netting set

EAD = Exposure at Default

RW = The applicable risk weight for a specific counterparty

DF = Discounting factor

α = 1.4

Simplified approach

In line with its name the Simplified approach is what is sounds like, Simple. Institutions can

simply take their CCR capital requirement and apply the same requirement for CVA risk.

Standardised approach

Before approval for using SA-CVA the institution needs to assess whether they comply with

the requirements to use the method. One of the requirements are that the institute has a

distinct unit that is responsible for the overall management of CVA risk, in addition the

institution needs to develop a regulatory CVA model for each counterparty.

The new method is far more sensitive for various risk factors, such as interest rate curves,

inflation, exchange rates and credit spreads. This in turn will require institutes to consider

new aspects of risk and will be more burdensome in terms of the implementing complex

methodology.

What path to choose?

The choice of method depends on the complexity of the institution and the most suitable

approach depending on the implementation cost and most sufficient capital requirement.

Category 3 and 4 institutes will most likely choose the Basic Approach or the Simplified

approach. Institutes that currently use the SA-method can benefit from implementing the

Basic Approach due to some similarities in the calculation.

How can FCG assist

FCG can help you navigate the new CVA framework and evaluate the most suitable method

for the CVA risk calculation taking your specific business model into consideration. Due to

the complexity of the new calculation’s institutions will need to adapt their data collection

and set up new processes for consolidating and reconciling results. FCG have extensive

experience in implementing new regulations in complex data environments, enhancing the

regulatory reporting and treasury functions. We can also help you in your application to the

authorities to assess if your institution complies with the requirements set out for usage of

SA-CVA.

Enhance your Treasury operations

Stay compliant and prepared for the future, learn more about how our Treasury offer can support your organization.