Sustainability Compliance Assistance

Sustainability is an umbrella term that encompasses a company's efforts to reduce its impact on the environment. Many insurance and reinsurance companies have a vague idea of what they need to do to integrate sustainability into their business, and struggle with measuring and reporting performance.

Sustainability risks are risks that can affect a company’s risk profile due to ESG (Environment, Social, Governance) factors and constitute the possibility of loss driven by ESG factors. An environmental, social, or governance-related event can cause an actual or potential negative impact on a company, e.g., on the value of investments or debts, the financial position, result, and reputation etc. The environmental dimension is often what most of us think of when we think of sustainability. It is focused on improving a company’s environmental performance. It can include things like reducing carbon emissions, improving resource efficiency, reducing waste, and complying with environmental regulations. It can also include things like climate risk management. The social dimension is focused on a company’s impact on its employees, customers, and society. This can include things like workplace safety, employee engagement, diversity and inclusion, customer satisfaction and even data and integrity. The governance dimension is focused on a company’s leadership and structure. Issues such as how much managers are paid, who sits on the board, whether shareholders get to vote on important issues and even how a company conducts audits and prevents bribery and corruption, all fall under the governance dimension.

Impact on insurance and reinsurance companies

ESG places great emphasis on risk management, monitoring, and limiting risks across all three dimensions and this should be a key priority for all insurance and reinsurance companies. At the same time, perhaps the environmental dimension is the most prominent area initially for the insurance industry and we can see that insurance and reinsurance companies will largely be affected by climate-related risks.

Climate-related risks can be divided into two risk factors:

Physical risks (acute and chronic) arise from the physical effects of climate change.

Transition risks, that is, policy, legal, technology, market-sentiment and reputational risks arise from the changes in the social, economic, and political environment that are triggered by the need to adapt to a low-carbon economy.

These can affect insurance and reinsurance companies in different ways, below are some examples of important areas:

• A fall in the value of investment assets

• Negative UW results and increasing liabilities

• Increased balance sheet volatility and risk correlations due to similar types of risk exposures for assets and liabilities

• Increased statutory capital requirements for certain assets currently held

• Reduced solvency resulting from higher capital requirements and less risk diversification

• Reduced solvency and profitability due to increased liabilities and value depreciation of assets

• Increased costs for insurance coverage

• Restrictive insurance and reinsurance terms

• Higher physical risk profile due to climate change

• Limited access to reinsurance

• Endangers business continuity

Regulations

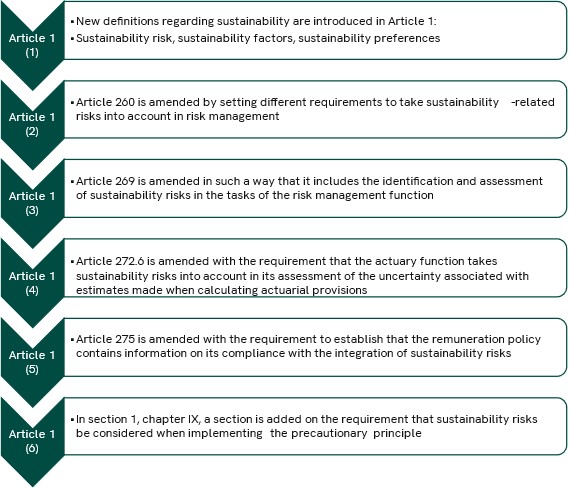

On May 24, 2018, the European Commission adopted a package of actions on sustainable financing. The package contained proposals aimed at establishing a uniform EU classification system for sustainable economic activity (“taxonomy”); improving disclosure requirements on how institutional investors integrate environmental, social and governance (ESG) factors into their investment and advice processes; and creating a new category of benchmarks that will help investors compare the carbon footprint of their investments. On July 24, 2018, the Commission requested EIOPA (European Insurance and Occupational Pensions Authority) to issue technical advice on potential changes to regulations to be adopted under Directive 2009/138/EC, regarding the integration of sustainability risks and sustainability factors. EIOPA published its final report on technical advice to the Commission on May 3, 2019. Some important regulatory requirements have been published since then regarding the implementation of sustainability risks. On April 21, 2021, the European Commission adopted a delegated regulation (Commission Delegated Regulation (EU) 2021/1256) amending Delegated Regulation (EU) 2015/35 (Solvency II Regulation) as regards the integration of sustainability risks into the governance of insurance and reinsurance undertakings. This regulation proposes changes in the Commission Delegated Regulation (EU) 2015/35 as follows:

The Solvency II regulation requires insurance and reinsurance companies to consider all risks they are or may be exposed to in the short and long term in their governance and risk management systems, even when these risks do not (fully) include in the calculation of solvency capital requirement. However, sustainability risks have not been explicitly mentioned in the Solvency II regulation. With this regulation, it is also clarified that insurance and reinsurance companies should continuously assess all relevant sustainability risks that, if they occur, can have a significant negative impact on the company.

This regulation has begun to be applied from August 2, 2022.

Implementation of the updated regulation

To integrate sustainability risks into the governance system, risk management system and ORSA in a good way, in line with Solvency II legislation, it is important for insurance and reinsurance companies to take the following actions:

• Establish a corporate strategy at board and management level to identify, assess, manage, and monitor sustainability issues in the business

• Establish processes for identifying and assessing sustainability risks in the portfolio

• Implement sustainability-related policies or update existing policies (including compensation policy) to include sustainability-related risks

• Assess sustainability-related exposures as part of risk management activities and identify and measure the impact on the business

• Integrate sustainability issues into investment decisions and ownership practices

• Incorporate ESG factors into decision-making, operation, and pricing

• Develop products and services that reduce risk, have a positive impact on ESG issues and encourage better risk management

• Integrate ESG issues into procurement and selection processes for suppliers

• Develop integrated risk management methods and solutions for risk transfer

• Consider sustainability risks in the calculation of technical insurance provisions and solvency needs

• Develop risk appetite for sustainability risks and identify risks that exceed the company’s risk appetite

• Ensure effective governance of sustainability risks and processes

• Identify suitable climate scenarios and data for climate-related scenario analysis

• Establish new modeling techniques and methods for stress testing

Own Risk and Solvency Assessment (ORSA)

Parallel to the commission’s work on integrating sustainability into existing regulations, EIOPA has also been working to promote a forward-looking management of climate change risks in ORSA to ensure the industry’s long-term solvency and viability. Insurance companies should distinguish between physical risks and transition risks, and explain their assessed effects in the short, medium, and long term.

EIOPA has published the following sustainability-related documents that affect the insurance company’s ORSA work:

• EIOPA-BoS-19/241 Opinion on Sustainability within Solvency II

• EIOPA- Sensitivity analysis of climate-change related transition risks

• EIOPA-BoS-20/561 Consultation Paper on draft Opinion on the supervision of the use of climate change risk scenarios in ORSA

• Application guidance on running climate change materiality assessment and using climate change scenarios in the ORSA

On April 19, 2021, EIOPA published a statement on the supervision of the use of climate change risk scenarios in ORSA. According to this, insurance and reinsurance companies should report the following in their ORSA:

- An overview of all material exposure to climate change risks

- An explanation of how the insurance and reinsurance company assessed the materiality and, if applicable, an explanation of the company’s conclusion that the climate change risk is not material

- The methods and main assumptions used in the company’s risk assessment of material exposures, including the analysis of the long-term scenario

- The quantitative and qualitative results of the scenario analyses and conclusions from the results

The identification of material climate change risks should be done through a combination of qualitative and quantitative analysis. A qualitative analysis can be used to analyse the relevance of the most important drivers of climate change risks, while a quantitative analysis can be used to analyse exposure to physical and transition risks. Companies should expose the identified significant risks to a sufficiently broad range of stress tests or scenario analyses, including short- and long-term risks associated with climate change. However, it is not required for the company to perform detailed forecasts of all result and balance sheet items and all SCR components.

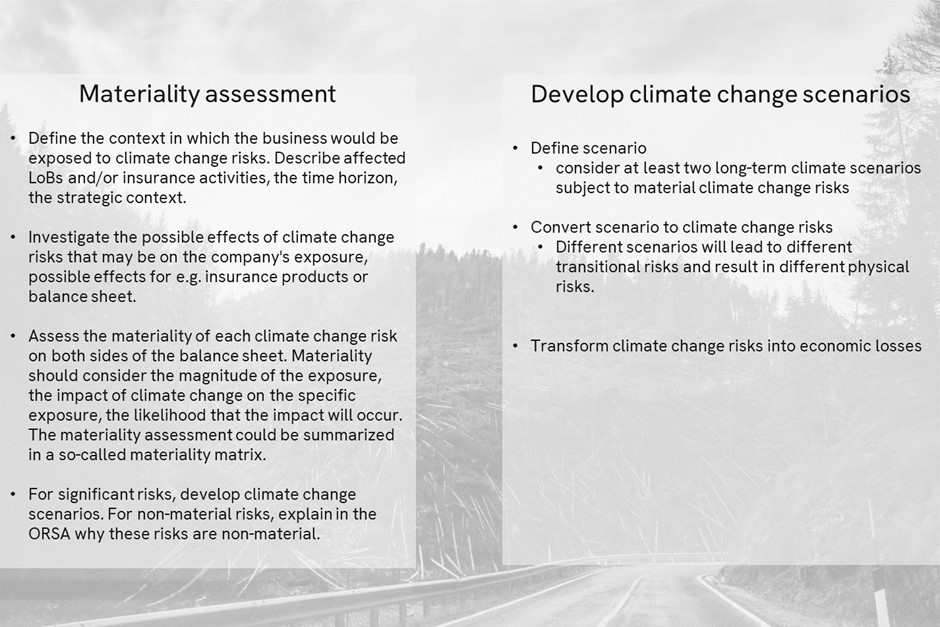

According to the regulations, at least two long-term climate scenarios should be developed where appropriate: i) where global temperature increase remains under 2°C, preferably not more than 1.5°C, and ii) where global temperature increase exceeds 2°C. The development of climate change risk analyses should be proportionate to the size, character, and complexity of the company’s exposure to climate change risks. Companies without previous experience can begin analysing long-term climate scenarios in a highly qualitative manner, but there should be a systematic improvement in the scope and sophistication of quantitative scenario analyses. Long-term scenarios for material exposures do not need to be updated on an annual basis if it can be justified that no new material exposures have arisen. It is also worth noting that the requirement for two long-term climate scenarios does not apply to companies that have concluded and explained that the climate change risk is not material.

As a follow-up to the above statement, on August 2, 2022, EIOPA also published a guidance document on performing a materiality assessment of climate change and using climate scenarios in ORSA. According to this guidance, the company should follow the following steps to perform a materiality assessment of climate change and use climate scenarios in ORSA:

Finding the right tools/data for the right analysis and to perform materiality assessment is a real challenge for insurance and reinsurance companies. To be able to perform materiality assessment, the impact, probability, and time horizon should be analysed. Insurance and reinsurance companies can use the results from the analysis of how climate change would affect the balance sheet and show it in a materiality assessment matrix. The mapping between climate change risks (physical risks or transition risks) and which aspects would be affected in the balance sheet could be done in the materiality matrix based on an impact and probability perspective. One of the challenges of designing analyses for climate change is defining a suitable time horizon that captures the relevant climate risk dynamics over time. The time horizon used in connection with climate change tends to be significantly longer than the usual business time horizon that is typically used by insurance and reinsurance companies for stress testing in ORSA. Different insurance activities require different time horizons and the time horizon for analysing climate change risks should be compatible with the company’s long-term commitments. The effects of climate change on medium- and long-term can be assessed by the insurance and reinsurance company over the next 15-30 years.

The purpose of forward-looking scenario analysis is to assess and discuss the robustness of insurance and reinsurance companies’ business strategies under different developments of climate change risks over time. By correctly measuring and reporting sustainability risks and integrating them into risk management and ORSA, the company can be at the forefront of best practice, correctly calculate the total risk cost for the business, understand the overall risk profile and preventatively mitigate specific risks to reduce the likelihood or consequences of potential sustainability-related losses, become environmentally and socially aware, have good governance structure and reduce negative impact to the business.

Concluding remarks

Through the aforementioned updates of the regulations and accompanying guidelines, it is clear that sustainability is and remains a central area for insurance companies in the future. At the same time, it is an area where there is a lot going on and parallel to legislation, the industry is working to adapt and enable, for example, the development of relevant data to manage sustainability risks. With that said, it is a big challenge for insurance companies to adopt the new regulations and the risks that are becoming more and more obvious. But even though it is a challenge and many uncertainties exist at this time, insurance companies are wise to take on the core of the regulations, that is, to look at what sustainability-related challenges/exposures your insurance company is facing in order to be better prepared for the future.