How Swedish households are getting squeezed by the energy crisis

Summary

We are now witnessing some extreme cycle movements in our markets where energy and interest rate markets are being impacted by global inflation and supply conflict. Sweden has also been impacted in the energy sector which, compounded with higher rates, will lead to less household income, lower property prices and consequently a stressed credit environment. The direct impact to household economics will require the banks to be on top of their game even more. The Swedish FSA does issue detailed reports on household economic health in a mortgage sector context, but a lot has happened since the last report was issued. More monitoring of credit quality, improved PnL management, consideration of affordability, modelling household level abilities to pay bills and mortgage payments, covered bond health, credit/interest rate/ and pricing policy, Risk Comm and Board level involvement on steering risk levels and financial strategy are all key to managing through this crisis. Not to forget ESG and the strategic positioning towards the responsibilities and opportunities associated with this crisis.

(The following article focuses on the Swedish mortgage market whilst we appreciate and realise that economic difficulties are being realised across Europe.)

Financial consequences for a representative household

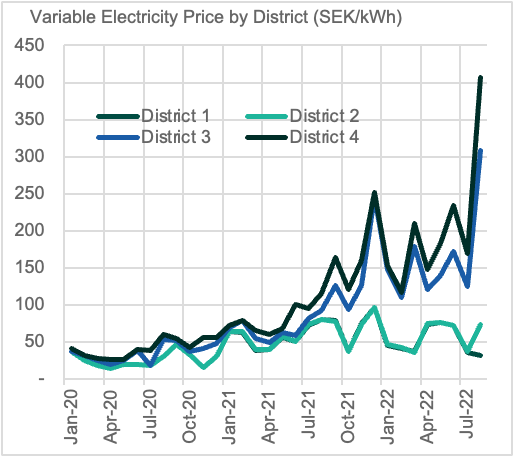

The phrase “Eating or Heating” has become a common phrase in Europe. Sweden has also been impacted by higher European energy prices which has led to doubts about Sweden’s electricity pricing system. Sweden is separated into four geographical pricing districts where the energy price is driven by different factors under a system with low or no transmission within Sweden, and different factors that drive the energy price in each district.

The current energy infrastructure does not account for the possibility of variation in price drivers between the districts and therein the extreme price volatility between the four. As of August, the price ranged from 0.31 SEK/kWh in the northern parts (District 1), to 4.06 SEK/kWh in the southern area (District 4).

This price discrepancy will likely continue to increase as the Southern district is driven by European prices of energy that are reliant upon gas fueled power plants.

To understand the financial consequences for the individual household from energy price inflation, let us establish a “benchmark” household consisting of two adults and two children living in a single-family home in Malmö (District 4) and use public data for constructing the financial position and potential consequences from higher interest rates and increased energy prices.

Each year, The Swedish FSA publishes a Swedish Mortgage Market Report (“Den Svenska bolånemarknaden”, the Report) that includes household economic data. The takeaways from the latest Report in April 2022 include:

- Swedish households continue to increase their debts

- Higher inflation and higher interest rates reduce the financial margins in the households

- Debt-to-income ratio continues to increase for new debtors as they are more sensitive to interest rate increases.

The FSA has run their calculations and found that, under an interest rate assumption of 7 percent, 11 percent of new mortgage customers would find themselves in a situation where their costs exceed their income (an increase from 8 percent over last year). However, our ambition within this article is to also consider the current and potential situation in the energy market and ultimately, the electricity bill that the households may face the coming Swedish autumn and winter. More specifically, we consider the current situation for our benchmark household.

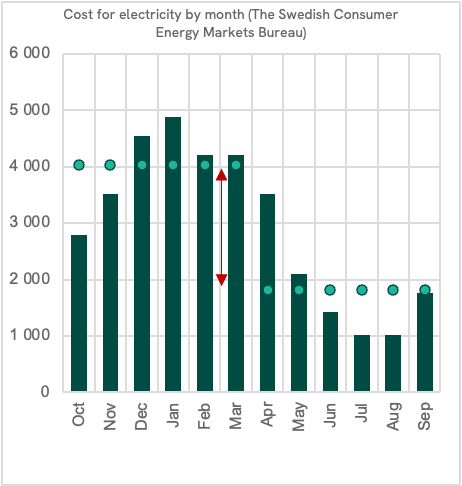

According to the Swedish Consumer Energy Markets Bureau, a single-family household heated using direct electricity consumes approximately 20.000 kWh/year. For such a household, at SEK 1.75 kWh (average cost in 2021 for a single-family home, Energy Markets Bureau), the total yearly cost of electricity (fees, taxes etc. included) amounted to approx. SEK 35.000.

The situation at hand is however that we are now entering the winter period where the energy consumption is higher. By separating the October to March-period, the average consumption is higher by a factor of 2.2. compared to the six-month period of April-September.

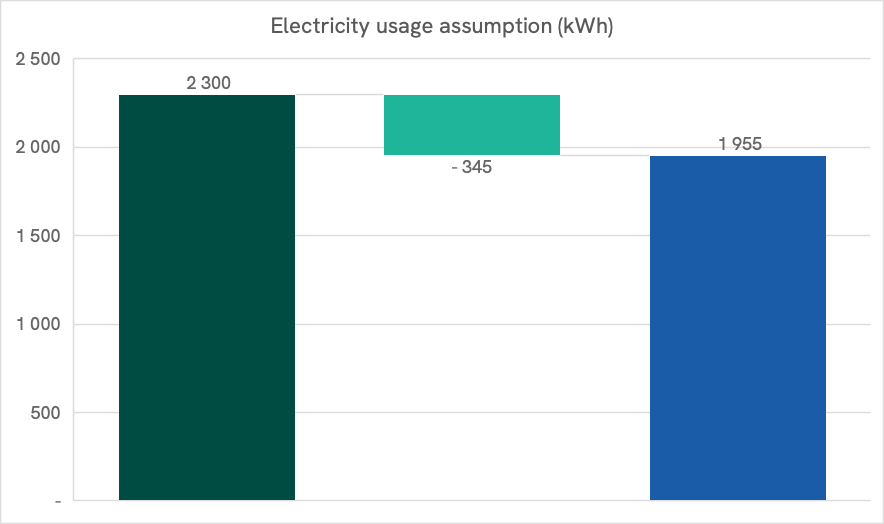

Granted, the electricity consumption in the most southern parts of the country differ to the consumption in the north due to temperature differences, and we lack the details on what the specific geographical curves look like (the data used for this purpose is expressed as a national average). So in a slightly naïve effort to consider this differential, we simply make the assumption that we can reduce the national average by 5% to account for this effect (we make example calculations for the purpose of illustration rather exact figures to describe impact). Additionally, it can be estimated[1] that for each degree warmer inside, the electricity bill becomes roughly 5% more expensive. In addition, we assume that the benchmark household accepts a reduction of the indoor temperature by one degree, which reduces electricity consumption by an additional 5%. Last, we consider the impact from Swedish newspapers being flooded with articles about how to cut the electricity usage. Accordingly, we assume an additional 5% reduction because of a more restrained approach to electricity consumption.

From the above, we assume an overall reduction of -15% in comparison to the starting point in the Energy Markets Bureau example.

Under our (albeit guesstimated) view on electricity consumption, what financial characteristics can be associated with our benchmark household

The Mortgage Report breaks down detailed statistics collected from the mortgage providers into distinct groups and geographies, and the reported average mortgage debt in Malmö (for co-living adults) amounted to SEK 3.4m with an average market value of the property at SEK 4.9m (LtV 70%).

During 2016, the government enforced amortisation requirements on mortgage loans (with possibility for case-by-case moratoria) which put more pressure on certain household expense levels. Amortisation of 2% of principal debt for mortgages with a LtV higher than 70%. Amortisation of 1% was applied for mortgages with LtV levels between 50%-70%. This requirement became stricter during 2018 when an additional amortisation requirement based on debt ratio was introduced. Households that have debts that exceed 4.5 times their gross income were required to amortise their mortgage loans by an additional 1% per year. Following the application of the revised amortisation rules, the average amortisation rate for new mortgagees was reported to be 1.95%, a level that we will carry forward in the analysis of our benchmark household.

Near the end of their Report, The FSA also provides information on the cost-of-living- and maintenance expenses (Swedish: Kvar Att Leva På-kalkyl [KALP]). These expenses are used by the FSA in the analyses in the Report and is viewed as broadly representative for the input used in the actual loan approval process at the banks. The repayment capacity calculation is a debated topic since banks may use different inputs and assumptions in their credit process, creating an inequitable calculation between the banks. Leaving that aspect aside for now the FSA reports an assumption SEK 29.200 in expenditures per month for our benchmark household (although not broken down by geographic location).

The Report was however published in April 2022 and much has happened since then economically speaking. There has been accelerating inflation rates (measured as KPIF) which are critical to household expense levels. The current inflation rate is approximately 8% and adjustments for this are considered necessary and appropriate to understand today’s household expense levels.

Two additional assumptions are considered in order to adjust the input used by the FSA to our current economic reality. We first assume that the Report has electricity prices at a level of 1.75 SEK/kWh to isolate the energy cost factor in the calculation of household costs. This assumption may or may not be conservative due to the unprecedented energy price volatility and lack of predictability. Second, we consider that the remaining part of the calculation will be subject to further increases of inflation at 8%. Applying these two assumptions in the cost of living / maintenance calculation is deemed providing a more accurate assessment under the most recent economic conditions.

Continuing our discussion further, we should also consider household income impacts as well as the adjustments on household expenditures already discussed. According to the Report, the monthly disposable income for two adults in Malmö is estimated to SEK 63.000. From current standpoint, this figure seems to be a reasonable reflection of the current situation without the need for adjustment.

After consideration of adjustment to the key components of household expenses and income, we can now run affordability calculations / illustrations of the cash flow position for our benchmark household at different interest rate and electricity price scenarios.

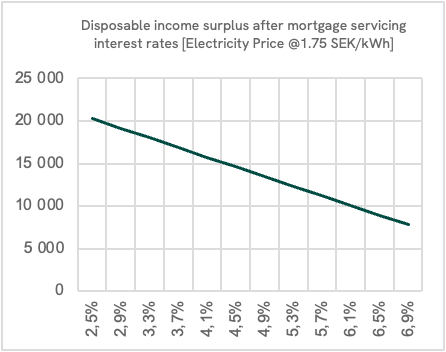

Warming up, we assume the SEK 1.75 kWh electricity price in the affordability calculation to test the consequences of different interest rate scenarios.

Using a 7% interest rate example on mortgages, the surplus in disposable income is SEK ~7600 for our benchmark household (pls note that we are not including tax deductions into the calculations since we are viewing the situation at hand from a day-to-day liquidity perspective).

This gives merits to the view that banks apply relatively strict standards in terms of testing the household economics for high interest rates in their own affordability calculation.

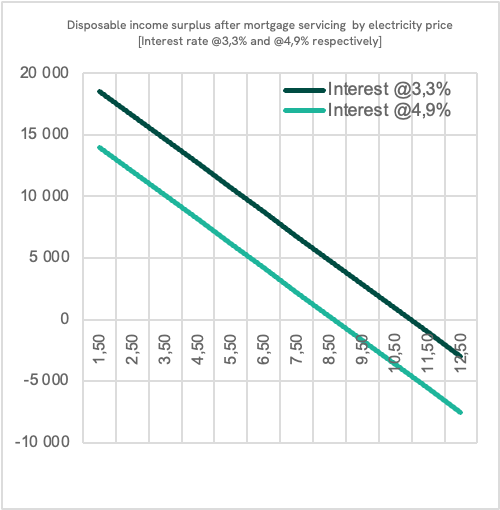

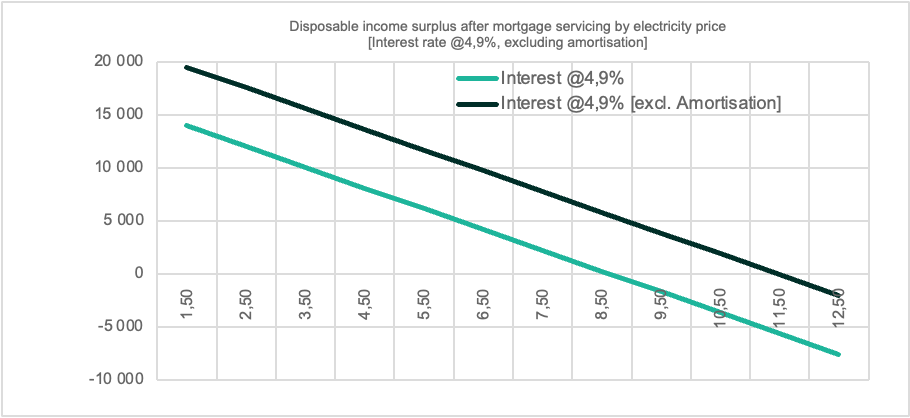

But to what extent may the inflation in energy prices impact the disposable income of our benchmark household after servicing the mortgage and paying for electricity?

Fixing interest rates (arbitrarily) as a constant against various electricity price levels, we observe that when the price approaches SEK 11.0 kWh, combined with a mortgage interest rate of 3.3%, would cause our benchmark household to run a monthly deficit during the period October-March. While these energy prices can be viewed as extremes, bear in mind the latest regional prices (at the time of writing) for 1 year fixing of the price was set at SEK 7,62 kWh. With uncertain volatility of future prices, the 11.0 level could become a reality for households in District 4 (and potentially also District 3).

If we use the SEK 7,62 kWh price as a target and consider that the benchmark household held a mortgage with an interest rate of 4.9%, the disposable income will drop by ~85% down to 2.000 after serving the mortgage and paying the electricity bill (compared with the price of SEK 1.75 kWh).

An interesting question that comes to mind when running these energy price and interest rate scenarios is “what impact is there to the wider economy if household’s disposable income (after mortgage and electricity) is reduced by 50-70% or at even higher levels in districts that cover almost 90% of the total mortgage market?”

Currently, an interest rate of 4.9% is considered high but again inflation is very high, and we cannot be certain about future levels of interest rates. But it is also important to consider the mortgage market as a whole.

The Report provides a model for deriving stressed market values using different inputs and presents a scenario where households expect the interest rate to increase by +1%, combined with an electricity price increase of +100% and where the outcome of the scenario is a property price fall of 19%. Unfortunately, current economic conditions and forecasts, have to an extent, passed the interest rate and energy price severity levels embedded within these scenarios. The full impact of property market decline is yet not known.

If sharp declines are materialising and are combined with increased default rates in the mortgage portfolios, there is an increased risk for price and credit pressure on the covered bond market. This would in turn increase the banks funding costs and put pressure on net interest margins. Higher funding costs and stressed margins lead to significant implications to sustainable bank profitability. The likely outcome of margin pressure will be to pass the cost onto mortgage prices (rates charged to the customer).

To close our illustrative example on how a typical household may become subject to severe financial stress, we summarize some key messages to take further actions in the following:

- In the short-term, review the operational capacity for managing a moratorium for the stricter amortisation requirement

- Continual evaluation of customer credit status through these changes: Ensuring accessibility to instructions, tools and data throughout the credit management process, including a (re)view of set priorities for customer interaction.

- Perform a thorough review of the credit portfolio: incorporate multiple scenarios for how the situation may resolve in the stress testing programme. Specifically with regards to stress tests, incorporate sufficient micro economic features to cater for the situation at hand.

- Embed the credit review and stress test output into financial planning: ensure that the stress test output is appropriately considered in the financial / capital / liquidity planning processes.

- Include affordability calculation discussions in the risk committee agendas and interact with the business divisions in designing updates to the input parameters that balances prudent risk management with objective of providing credits to creditworthy customers. The features and input must align to both consumer protection standards while also consider both short- and medium-term perspectives on disposable income calculations etc. (a case for dual calculations?)

- With respect to the preceding bullet, engage in product development initiatives and find opportunities in how the bank can attract new customers, or incentivise existing ones, in reducing energy consumption at attractive terms and conditions.

- Use available internal data and source / design the collection of relevant auxiliary data for the purpose of identifying the characteristics of the customers / collateral. What does it mean from a risk management perspective to have sub-portfolios of single-family houses with an energy consumption significantly above average? What is the impact from this short-, mid- and long-term and what are the consequences for the possibility to issue covered bonds or other instruments?

- Review and propose updates to the collection strategies in accordance with the overall financial- and operational strategies formulated by the bank to ensure a tailored yet consistent approach if households are progressing into financial difficulties.

- Finally, initiate a discussion at senior management on what opportunity the bank has in terms of the “S” in ESG. Would it even be a financially rational decision to provide support (set lower return targets) to the mortgage portfolio to stave of decreasing portfolio performance at other ends of the banking book or business lines?

Initiatives that adequately addresses and eases the situation may- or may not be presented by European- or national officials, but a well implemented and integrated business- and risk steering model ensure the preparation for either outcome.

The calculations made in this article are to be viewed as illustrative and where the financial situation, energy consumption etc. is unique for each household.

[1] https://www.affarsverken.se/hjalpcenter/el/artiklar-och-berattelser/kallt-ute-och-varmt-inne--darfor-blir-elrakningen-storre-i-vintertid/